- Bank of america international transfer how to#

- Bank of america international transfer code#

- Bank of america international transfer download#

Many online bank systems allow you to view the routing and account numbers from your customer dashboard. Your local Bank of America branch or toll-free support line can provide you with routing numbers. Other ways to confirm the correct Bank of America routing number include:

Look at a paper check associated with your Bank of America account to find the routing and account numbers for your account.

Bank of america international transfer how to#

How to confirm the routing number for Bank of America on your own SWIFT codes are a unique combination of letters and numbers that identify specific banks and financial institutions around the globe.Ĭodes indicate four pieces of information used to exchange money internationally between accounts:

Bank of america international transfer code#

The SWIFT code for international wire transfers through Bank of America is BOFAUS3N. You can use this same number to receive international wire transfers to your Bank of America account. The routing number for US wire transfers through Bank of America is 026009593.

The ACH number and your bank account number are used by banks and transfer apps like Zelle or Cash App to identify the exact account payments should be taken from and sent to.īank of America wire transfer routing number Short for Automatic Clearing House, ACH numbers are unique to each bank in the US. The ACH routing number for Bank of America is 026009593. Wire payments to an international accountīank of America ACH transfer routing number The routing number you need to send or receive money through Bank of America depends on whether your payment or transfer is domestic or international. Which Bank of America routing number do I need?

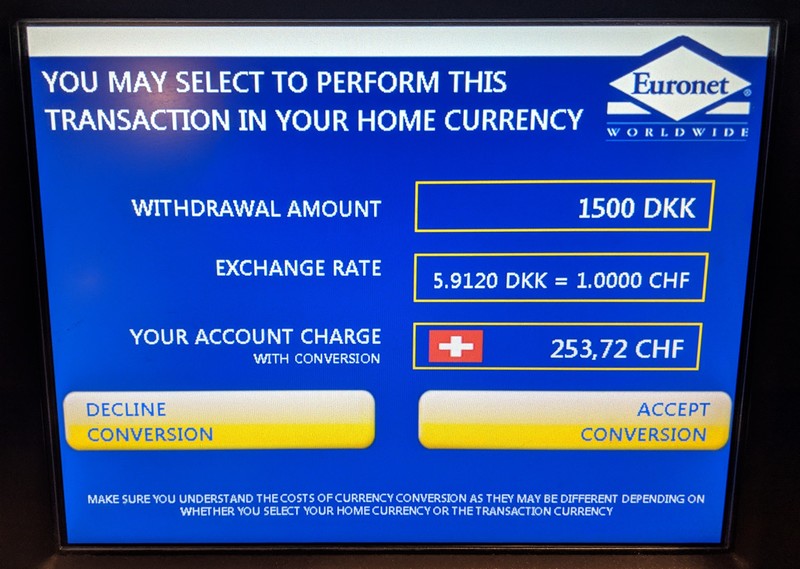

Learn how to find the exact routing number you need for your Bank of America account. You'll need this eight to 11-digit code so that banks can locate your account and process transactions like checks, automatic payments, online payments and money transfers in the US and worldwide. All international money transfer servicesīank of America uses different routing numbers depending on several factors, including payment type and the transaction's origin or destination.NetBank access with NetCode SMS required.Ĭommonwealth Bank of Australia ABN 48 123 123 124. Terms and conditions are available on the app.

Bank of america international transfer download#

The CommBank app is free to download however your mobile network provider charges you for accessing data on your phone. Find out about the minimum operating system requirements on the CommBank app page. Returned funds will be converted back to the currency of the funding account at the published Bank buys IMT rate on the day it is credited to the funding account.ģ Overseas bank charges (which may vary from country to country) could apply in addition to the charges listed above.Ĥ Fee charged depends on arrangements with overseas banks. Read about our IMT terms and conditions for NetBank and the CommBank app and our terms and conditions for pay to international mobileĢ This is a request only and is dependent on the overseas bank obtaining the relevant debit authority to be able to return funds. For more information about fees and charges for international payments, read our Standard fees and charges for international payments and travel funds. using an AUD account to send a payment in USD.įind out more about Fees and charges for IMTs.ġ All fees are stated in Australian dollars. We’ll pay any correspondent bank fees when you send a cross-currency IMT – e.g. We won’t cover any fees that may be charged by the beneficiary’s bank. If you use a Foreign Currency Account to send a same-currency IMT, for select currencies, you have the option to pay a separate upfront fee to cover the correspondent bank fees. We'll pay any correspondent bank fees when you send a cross-currency IMT (Japanese Yen excluded). using an AUD account to send a payment in USD. We’ll pay any correspondent bank fees when you send an IMT in any currency, as long as the originating account currency is different to the payment currency (cross-currency IMT) – e.g. When you send money overseas using NetBank or the CommBank app, we’ll waive the transfer fee.

Sending an IMT using NetBank or the CommBank app

0 kommentar(er)

0 kommentar(er)